Welcome to the Pastoral Finance Blog.

Here, you'll find practical financial insights tailored for pastors and ministry leaders. These articles are a free resource designed to help you navigate everything from tax planning to retirement, side hustles, and church financial management.

Looking for something specific? Use the search bar below to explore our library of content.

You’re in Your 50s and Unsure of Your Financial Future: Where Do You Start?

Laptop on a wooden desk with soft natural light and the text ‘How to Build a Financial Plan, A Step-by-Step Journey for Pastors, Part One: Where Do You Start?’ displayed above. Minimal, professional header image for a pastoral financial planning series.

7 of the Biggest Financial Blind Spots for Pastors in Their 50s

Most pastors reach their 50s with decades of faithful ministry behind them but with growing uncertainty about their financial future. This post breaks down the seven biggest blind spots pastors overlook at this stage of life, including retirement gaps, Social Security strategy, housing allowance issues, Medicare timelines, and more. Understanding these now can change your entire next season.

Why Pastors Cannot Afford Not to Have Ongoing Financial Planning

Most pastors rely on a one-time financial plan without realizing it becomes outdated almost immediately. This post explains why ongoing financial planning matters and how it helps pastors gain clarity and confidence as their lives and ministries shift.

The Financial Mistakes Pastors Often Make During a Move

Moving to a new church can be one of the most exciting and stressful seasons in a pastor’s life. But it can also be one of the most financially vulnerable. From housing allowance paperwork to delayed paychecks, even seasoned pastors can overlook critical details that lead to unnecessary stress. Here’s how to prepare wisely and keep your finances steady when ministry takes you somewhere new.

The Year-End Financial Checklist Every Pastor Needs

Most pastors end the year exhausted but not necessarily ready. This simple checklist will help you review housing allowance, payroll, benefits, giving, and taxes so you can finish the year with clarity and start the next one with confidence.

Pastor are You Financially Healthy? A Simple Checkup for Pastors

Every pastor needs a financial checkup just like a physical one. These seven questions help you assess your financial health and build lasting stability in ministry and life.

5 Financial Myths Many Pastors Believe and Why They’re So Costly

Pastors are quick to spot bad theology, but many unknowingly live by financial myths that cost them dearly. These myths can undermine retirement security, family stability, and the ability to finish ministry well. Discover five of the most common financial myths pastors believe and learn practical, faith-driven wisdom to build a stronger financial foundation for life and ministry.

The Retirement Mistake Most Pastors Don’t See Coming

Many pastors unknowingly sabotage their retirement by withdrawing money in the wrong order. Housing allowance, 403(b) distributions, Roth IRAs, and Social Security all interact in unique ways for clergy. Learn why a thoughtful withdrawal plan matters and how avoiding this common mistake can protect your future.

Will I Ever Be Ready to Retire?

Will I Ever Be Ready to Retire?

Retirement looks different for pastors. It’s not about escaping a job, but stepping into a new season of ministry with clarity and purpose. This post explores the spiritual, emotional, and financial questions pastors must wrestle with as they consider what retirement really means—and how to plan for it with confidence.

The Painful Surprise No Pastor Wants to Discover About Their Paycheck

What happens when your paycheck was set up wrong… and no one realized it until the IRS did? For pastors, compensation errors aren’t just accounting issues—they can lead to legal risks, broken trust, and years of regret. This post walks through the most common church payroll mistakes, why they happen, and what pastors and boards must do to protect both the mission and the messenger.

Your Church Isn’t Your Retirement Plan

Too many pastors are quietly banking on goodwill, parsonage access, or a future board’s generosity to carry them through retirement. But what happens when the leadership changes, the promises weren’t written down, and the church can’t afford to do what they hoped it could?

In this post, we confront the myth that “the church will take care of me,” and offer five practical, pastor-specific steps to start building a secure future now.

Read the Fine Print: What Pastors Need to Know Before Rolling Over Their 403(b)

Rolling over your church 403(b) could cost you tax benefits and more. Before you move your money, here’s what every pastor should know and ask.

The Hidden Cost of Living in a Parsonage: What Pastors Need to Know

While parsonages offer immediate housing solutions for pastors, they may inadvertently hinder long-term financial growth. This article explores the implications of parsonage living on retirement, taxes, and net worth, offering clear steps to build financial security.

Should Pastors Pay Off Their Mortgage Early? Key Considerations for Ministers

Wondering if you should pay off your mortgage early as a pastor? This guide explains how clergy housing allowance, retirement planning, and financial trade-offs impact your decision.

How Is Your Pastoral Salary Being Set? 5 Things Every Pastor Should Know

When it comes to pastoral compensation, transparency matters just as much as generosity. Many pastors are unaware of the legal and ethical best practices around how their salary is set—or who should be involved. If you’re navigating compensation as a lead pastor, board member, or church planter, this post will help you avoid common mistakes and establish a process that reflects both integrity and wisdom.

3 Tax Moves Pastors Can Still Make Before April 15

The deadline is here, but it’s not too late. Here are three strategic tax moves pastors can still make before April 15—including how to review your housing allowance, retirement contributions, and 2025 withholding plan.

5 Things Every Pastor Should Know About Taxes (Before You File)

Tax season is different when you’re in ministry. From housing allowance to outside income and retirement contributions, here are 5 key things every pastor should understand before filing. These aren't tips for deductions — they’re reminders that could save you stress, money, and time.

Should Pastors Roll Their 403(b) into an Annuity? Stop and Consider These Risks First

I've recently spoken with pastors who rolled their 403(b) funds into an annuity while still working—only to regret it later. What seemed like a great decision at the time turned into frustration as they uncovered fees, restrictions, and tax complications they didn’t fully understand. Before making a move, take a moment to consider the real cost of an annuity and whether better alternatives exist.

Navigating the Clergy Housing Allowance: Best Practices and Pitfalls to Avoid

Many pastors receive a housing allowance, but not all understand how to maximize it or avoid costly IRS mistakes. This guide breaks down the best practices for setting up a clergy housing allowance, keeping records, and staying compliant with IRS rules. Learn what expenses qualify, how to avoid common pitfalls, and what documentation you need in case of an audit.

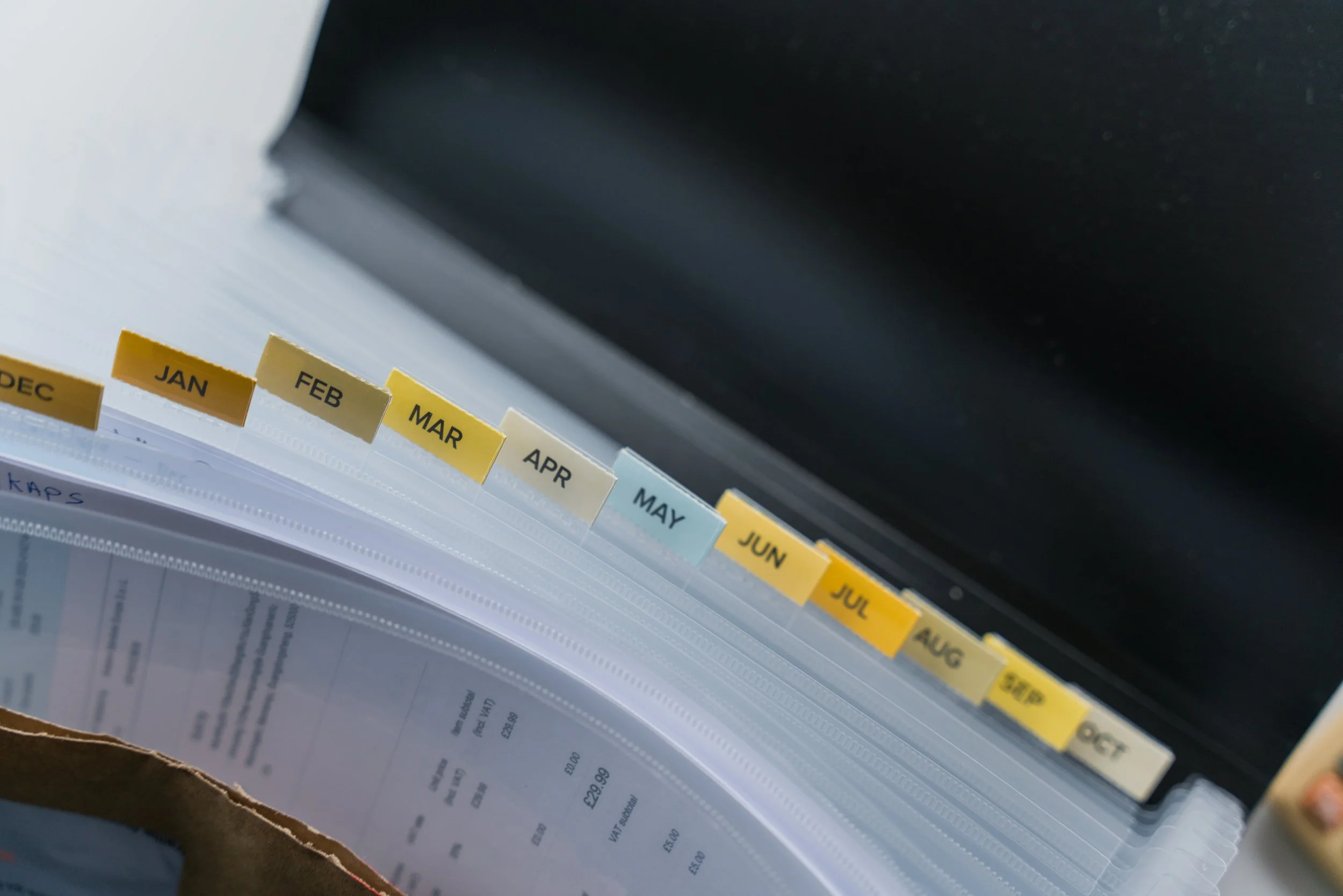

What Financial Documents Should Pastors Keep and For How Long

Many pastors assume their tax return is enough to prove their housing allowance, but without the right documentation, they could be in for a surprise if the IRS comes calling. Knowing what financial documents to keep—and for how long—can protect you from unnecessary stress. This guide breaks down exactly what pastors need to save for taxes, ministry expenses, retirement, and more. Plus, grab a free document retention checklist to keep your records in order.