What Financial Documents Should Pastors Keep and For How Long

A few years ago, a pastor friend of mine called me in a panic. He had just received a letter from the IRS. They were reviewing his past tax returns and wanted proof of his housing allowance designation.

No problem, right? He had claimed it every year. It was listed on his W-2. His tax preparer had filed everything correctly. But that was not what the IRS wanted. They were asking for official documentation from his church, something showing that the board had formally approved his housing allowance in advance.

That was when he realized the problem. His church was small, and while they had always discussed his housing allowance, they never kept proper board meeting minutes. There was no official record of approval, just an understanding between him and the church. And now, years later, he was scrambling to get something in writing to satisfy the IRS.

This is a situation many pastors do not think about until it is too late. If you do not have clear documentation of your housing allowance approval, you could be in for a stressful situation if the IRS ever asks for proof.

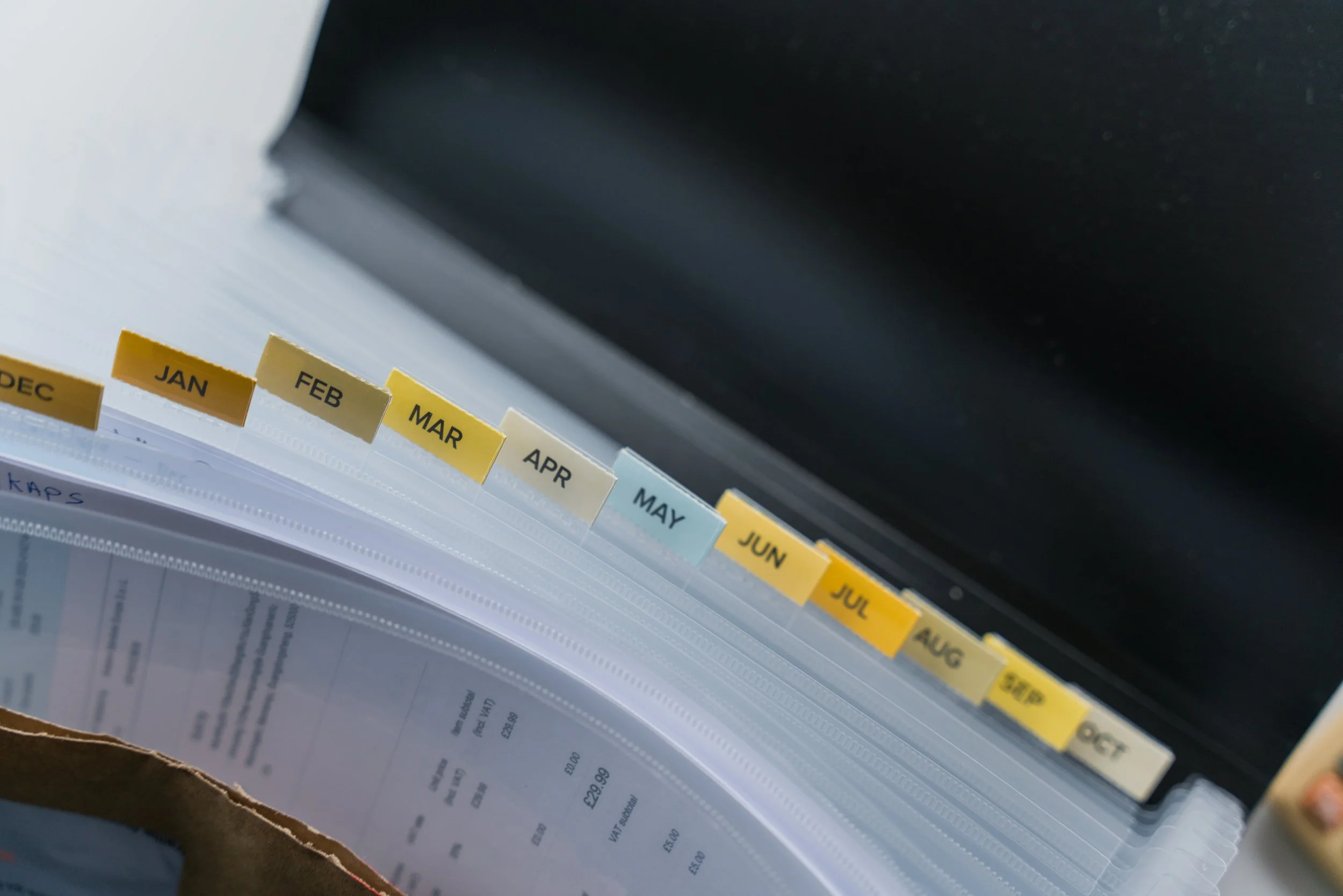

The reality is that keeping tax records is important, but keeping the right documentation, the kind that can actually protect you, is critical. Here is what you need to keep on file and for how long.

Tax Documents: What to Keep and For How Long

Income Tax Returns and Supporting Documents

If there is one thing you do not want to lose, it is your tax returns. The IRS has a three-year window to audit most tax returns, so that is the minimum amount of time you should keep them.

There are exceptions.

Keep them for six years if you underreported income by twenty-five percent or more.

Keep them for seven years if you claimed a bad debt loss or worthless investment.

Keep them indefinitely if you never filed, because technically, the IRS can come back at any time.

Pro Tip. Even though paper copies can be discarded after a certain period, it is not a bad idea to scan and keep digital copies forever. A simple PDF file of your tax returns takes up very little space but could save you a lot of hassle if you ever need to reference an old filing. Just be sure to store them securely, whether in an encrypted cloud storage system or an external hard drive.

W-2s and 1099s

If you receive a W-2, keep it for at least three years. If you are self-employed or receive 1099 income from speaking engagements, book sales, or other ministry work, keep those forms for at least three years as well.

If you have ever earned income under Social Security, keep all W-2s until you start collecting benefits. Errors in Social Security records do happen, and you want to be able to prove your earnings if needed.

Housing Allowance and Parsonage Records

This is one of the most common missing pieces in pastors' financial records.

You should always have a copy of the church board minutes or official paperwork that designates your housing allowance. The IRS requires it to be approved in advance. If you cannot provide documentation, your housing allowance could be disallowed in an audit.

Keep housing allowance documentation for at least three years, but it is a good idea to keep it indefinitely.

Keep supporting receipts for mortgage payments, utilities, and home expenses for at least three years.

If you live in a parsonage, keep rental agreements or any documentation from the church that outlines the housing arrangement.

Ministry and Business Records

Church Reimbursements and Business Expenses

If your church reimburses you under an Accountable Reimbursement Plan, keep those records for at least three years in case of an IRS audit.

If you are self-employed for part of your income, keep receipts for travel, books, office expenses, and equipment for at least three years.

If your church does not have an Accountable Reimbursement Plan, they should. This allows you to get ministry expenses covered tax-free instead of losing out on deductions. Be on the lookout for an upcoming blog post on how to set one up.

Charitable Contributions

If you tithe or give to other ministries, you need written proof for deductions.

Keep receipts for at least three years.

If donating non-cash assets like stocks or vehicles, keep valuation records and Form 8283 for at least six years.

Retirement and Investment Records

Retirement Plan Contributions and Distributions

Keep IRA and 403(b) contribution records forever to track your cost basis for tax-free withdrawals.

Keep 1099-R forms for retirement distributions for at least three years.

If you converted a Traditional IRA to a Roth IRA, keep those records indefinitely to avoid tax issues later.

Social Security and Medicare

Keep your Social Security card and annual benefit statements permanently.

Keep Medicare Summary Notices for at least a year or until all bills are paid.

Investment and Bank Statements

Keep monthly statements until the end of the year, then keep the year-end statement for at least three years.

If you bought stocks before 2012, keep records of your purchase price forever. Brokerages were not required to track cost basis back then.

Legal and Estate Planning Documents

Wills, Trusts, and Powers of Attorney

Keep your original will, trust, and power of attorney in a safe place.

Consider giving copies to your executor, trustee, or power of attorney designee.

Marriage Certificates and Divorce Records

Keep marriage certificates permanently for insurance and legal needs.

Keep divorce records permanently if they affect alimony, retirement benefits, or property ownership.

Military Service Records

If you served in the military, keep discharge papers (DD-214) permanently for benefits and eligibility verification.

Final Thoughts: Stay Organized and Protect Your Finances

I know this is a lot of paperwork to keep track of. But I have seen firsthand how a missing tax form, housing allowance approval, or investment record can cause major headaches for pastors.

If you do not have formal documentation of your housing allowance approval, take the time to get it now. Ask your church board to approve it properly and keep the records on file. If you do not have a system for organizing your financial documents, now is the time to start.

📌 Want a full checklist of what to keep and for how long? Click here to request your free Document Retention Guide.

Pro Tip. Scan important documents and store them securely online in case physical copies are lost or damaged. Most financial advisors also provide secure electronic storage options, allowing you to keep critical financial records safe and easily accessible. If you work with an advisor, ask about their secure document storage solutions.

If you have ever had to scramble for missing paperwork, drop a comment below. Let’s make this the year you get organized and financially protected.